|

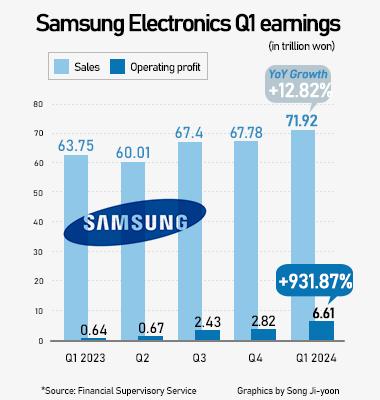

[Graphics by Song Ji-yoon] |

<이미지를 클릭하시면 크게 보실 수 있습니다> |

Samsung Electronics Co. reaffirmed its production plan for HBM3E 12-stack products in the second quarter of 2024 on Tuesday, in line with its aim to accelerate its presence in the HBM market. The South Korean tech giant is seen to be gaining a competitive edge with high-specification products as the market for generative artificial intelligence (AI) expands.

Samsung Electronics disclosed plans to increase 2024’s HBM shipments by more than three times compared to the previous year and to more than double it by 2025 during the conference call for its first-quarter earnings announcement.

“We are more than tripling the 2024 HBM shipment volume compared to the previous year based on the HBM bit growth,” Kim Jae-joon, executive vice president of memory business at Samsung Electronics, said. “We have also already completed agreements with customers for this volume.”

The company plans to at least double the supply volume of HBM in 2025 and is also planning to strengthen its high-spec DRAM offering, Kim added.

Server DRAM is expected to grow by more than 50 percent in the second quarter of 2024 compared to the same period in 2023. Samsung Electronics plans to enhance its competitiveness in the high-capacity DDR5 module market linked with AI servers with new product releases.

NAND flash memory, another component of memory, is also undergoing AI-specific adjustments alongside DRAM and successfully turned a profit in the first quarter of 2024. This is primarily due to the significant increase in the average selling price (ASP) compared to the previous quarter due to demand outweighing supply, and the outlook for the NAND market remains positive in the second quarter of the year.

Samsung Electronics also emphasized that the sales proportion of high-value NAND products, such as high-capacity server solid-state drives (SSDs), is increasing due to the proliferation of generative AI.

Samsung Electronics expected a 100 percent increase in second-quarter server SSD shipments compared to the previous quarter and an 80 percent increase in annual shipments compared to 2023.

“As generative AI models continuously evolve, we are seeing a surge in SSD supply requests for both training and inference fields,” Kim said.

But the stance is to approach easing reductions cautiously to establish a sufficient uptrend, with foundries that had fallen into a loss trend also slowly seeing growth again.

Samsung Foundry posted record earnings in the first quarter thanks to improvements in yield for advanced micro processes of 4 nanometer.

“The foundry revenue hit a low point in the first quarter of 2024 and is expected to rebound from the second quarter onwards, with double-digit revenue growth expected compared to the previous quarter,” Samsung Electronics vice president Song Tae-joong said.

|

[Graphics by Song Ji-yoon] |

Samsung Electronics expects that although overall market growth will be limited, revenue growth for advanced nodes of 5nm and below will outpace market growth in 2024. Plans are also underway to expand its long-term production capacity by commencing operations at its U.S. hub.

“We are preparing for the gradual operation of Taylor Factory in the United States, in line with customer order situations,” Song said. “We expect the first mass production to begin in 2026.”

The company will also accelerate technological development, with plans to develop a next-generation process, the 2nm design infrastructure, in the second quarter of 2024. The foundry business division will hold a Samsung foundry event in the United States in June, when it will unveil its foundry AI technology platform vision.

The System LSI business division is focusing on ensuring a stable supply of flagship system-on-chips (SoCs) and sensors as smartphone sales show signs of recovery. It is also preparing to ship new wearable products based on advanced process technology.

Display sales totaled 5.39 trillion won ($3.9 billion) and operating profit stood at 340 billion won, while Samsung Electronics’ first-quarter capital expenditure amounted to 11.3 trillion won, up by 600 billion won from the same period in 2023.

Semiconductor investment came to 9.7 trillion won and display 1.1 trillion won. First-quarter research and development investment amounted to 7.82 trillion won, surpassing the record previously set during the fourth quarter of 2023 at 7.55 trillion won.

이 기사의 카테고리는 언론사의 분류를 따릅니다.

기사가 속한 카테고리는 언론사가 분류합니다.

언론사는 한 기사를 두 개 이상의 카테고리로 분류할 수 있습니다.

언론사는 한 기사를 두 개 이상의 카테고리로 분류할 수 있습니다.