|

Derivatives-linked securities (DLS) tracking crude oils are on path to lose money for investors after international prices crashed 30 percent to 40 percent over the last couple of days to sink to four- year lows.

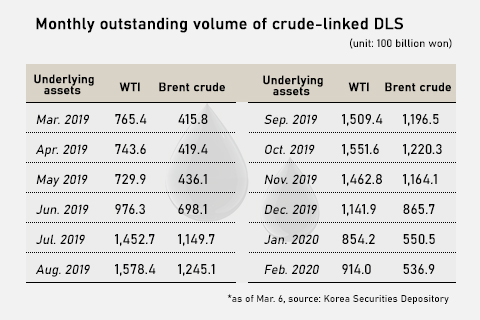

According to the Korea Securities Depository on Monday, the outstanding balance in crude-tracking DLS products amounted to around 1.02 trillion won ($854 million) – 640 billion won worth linked to U.S. West Texas Intermediate (WTI) crude, and 420 billion won to Brent crude.

Most DLS products have a ‘knock-in’ option. Buyers of the vehicles make money by receiving coupons at set intervals over the investment period. They however could face losses on their principal, if the underlying index falls below the knock-in threshold and fails to rebound to a certain level.

Investors fret they may not get full principal back if knock-in level is breached, which is about 50-55 percent of the initial reference price, now that underlying prices have hit multi-year lows due to clash between Saudi Arabia and Russia.

WTI on Monday slid 32% to its four-year low of $27.99 per barrel during Monday, extending the losing streak after the 10.1 percent drop last Friday. International benchmark Brent crude was at $31.5 a barrel on Monday morning, also with a fall of 31.5 percent, the worst one-day fall since the Gulf war in 1991. In the previous session, Brent crude lost 9.44 percent to $45.27.

|

WTI kept the $55 a barrel level in the latter half of last year when appetite for crude-based DLS products picked up on expectations for a recovery in the global economy. Most of the instruments sold have a knock-in level at 50 percent, and losses are incurred when crude prices go down to the $30 level.

The same happens to those based on Brent crude as the most also have a knock-in threshold of $30 per barrel.

Oil prices have dipped after the world’s largest oil producer Saudi Arabia announced a stunning discount in prices since the bust-up with Russia and the rest of APEC over production cuts. Fears about broader and lasting impact to the global economy from the ongoing COVID-19 outbreak also are rising.

On Monday alone, confirmed cases in the U.S. surged 324 to surpass 500. The virus is spreading much fast in Europe, especially in Italy.

“Oil prices will continue to stay at low until the second quarter. We revised down the expected price band of WTI for this year to $25-60 a barrel from earlier estimates of $40-70,” said Jeon Kyu-yeon, an analyst at Hana Financial Investment Co.

[ⓒ Maeil Business Newspaper & mk.co.kr, All rights reserved]