|

<이미지를 클릭하시면 크게 보실 수 있습니다> |

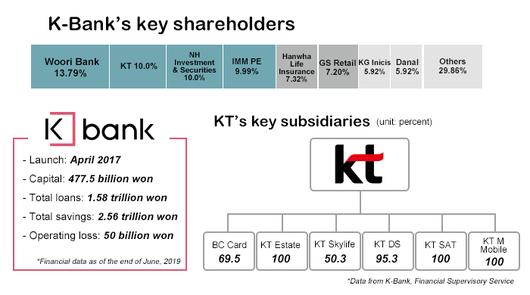

K-Bank hopes to gain much-needed capital fuel indirectly from its investor KT and normalize banking operation that has been lagging far behind its sole rival Kakao Bank before the third entry joins the internet banking market.

According to financial industry sources on Monday, K-Bank has recently completed a legal review of a plan to issue new shares to one of KT’s subsidiaries as part of its efforts to raise capital.

The deal will make a KT unit the internet-only bank’s largest shareholder instead of KT whose legitimacy to command a financial company came under question after it went under prosecutorial probe for antitrust issues. The candidates to replace KT could be BC Card, real estate manager KT Estate, and IT solution provider KT DS.

K-Bank has stopped loan servicing since April after its scheme to issue 590 billion won ($504.7 million) in new shares to KT to raise its stake beyond 10 percent fell through. Any stake in an internet-only bank held by a non-financial entity beyond 10 percent requires review from the financial authority. Once approved, the stake can be upped to a maximum 34 percent.

The scheme flopped after KT was charged for colluding prices and disqualified for the stake increase.

KT and K-Bank have come up with a Plan B by seating a substitute for the telecom company.

|

<이미지를 클릭하시면 크게 보실 수 있습니다> |

BC Card, in which KT owns a 69.54 percent stake, makes a plausible candidate except that KT would have to convince shareholders of the credit card unit. BC Card also may not be able to afford 500 billion won alone, given its financial standing. Its operating profit was 145.7 billion won and had 281.6 billion won in cash and cash equivalent assets in 2018.

Other candidates are KT Estate and KT DS. KT owns a full stake in KT Estate, whose asset amounted to 1.4 trillion won as of last year. KT owns 95.31 percent in KT DS, an IT solution unit.

Separately, KT also stands a chance to become K-Bank’s major shareholder itself. A revision in the local financial law has been proposed recently to allow a non-financial entity to become the major shareholder of an online-only bank even if it has a punishment history for fair trade law violation.

[ⓒ Maeil Business Newspaper & mk.co.kr, All rights reserved]

이 기사의 카테고리는 언론사의 분류를 따릅니다.

기사가 속한 카테고리는 언론사가 분류합니다.

언론사는 한 기사를 두 개 이상의 카테고리로 분류할 수 있습니다.

언론사는 한 기사를 두 개 이상의 카테고리로 분류할 수 있습니다.