|

[Source: Financial Supervisory Services] |

At least three aspirant teams have joined the preliminary race for the controlling stake in Korea’s full-service carrier Asiana Airlines Inc. with contestants ranging from a builder to an activist fund.

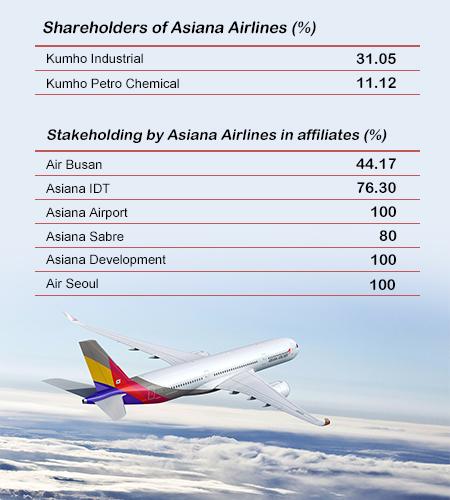

According to sources close to the deal whose initial deadline for non-binding bids is set for Tuesday, HDC Hyundai Development has teamed up with the country’s top brokerage house Mirae Asset Daewoo to vie for parent Kumho group’s interests in the airline whose value could near 2 trillion won ($1.65 billion) when including budget carriers and maintenance units.

The team makes the third after Aekeyung Group and home-grown fund Korea Corporate Governance Improvement (KCGI) which holds sizable interest in another full-service carrier Korean Air Lines.

HDC Hyundai reportedly jumped into the race for synergy effect with its duty-free business that the company jointly runs with Hotel Shilla.

Aekyung Group owning the nation’s top budget carrier Jeju Air officially announced its plan to bid for Asiana and named Samsung Securities its advisor in charge of carrying out due diligence, according to an official from the group’s holding entity AK Holdings.

KCGI also declared its bid and is seeking out strategic investors in logistics, aircraft leasing or IT to up its chances, according to an official from the fund. A financial entity cannot bid alone for an airliner.

The fund which is the second largest shareholder of Hanjin KAL, the parent company of the country’s flag carrier Korean Air Lines, is going after Asiana Airlines to bring about changes to the management of full-service airline industry long run by family owners.

Household business names like Hanwha, SK, Lotte and GS stayed away from the tender amid murky outlook for local air industry and the hefty price tag of up to 2 trillion won. Main creditor Korea Development Bank (KDB) sticks to its plan to sell two budget liners and flight service units in a package deal. The state-run lender also said on Monday that it disallowed Asiana’s second largest shareholder Kumho Petro Chemical Co. from participating in the bid.

Organizers plan to keep the tender open to invite more bidders.

[ⓒ Maeil Business Newspaper & mk.co.kr, All rights reserved]

이 기사의 카테고리는 언론사의 분류를 따릅니다.

기사가 속한 카테고리는 언론사가 분류합니다.

언론사는 한 기사를 두 개 이상의 카테고리로 분류할 수 있습니다.

언론사는 한 기사를 두 개 이상의 카테고리로 분류할 수 있습니다.