|

Korean insurers from top and bottom, and from life to non-life, are collectively struggling with losses ballooning from multiple whammies - policy cancellation from slowed economy, reduced income from fast aging and poor returns from low-interest rate environment.

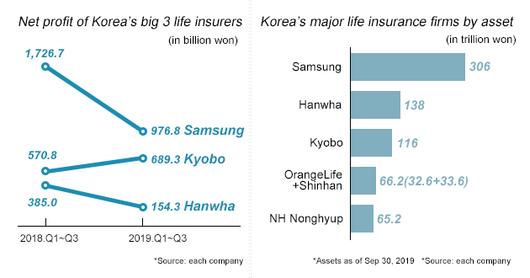

Hanwha Life Insurance, one of Korea’s three majors, recently reported its net profit for the third quarter ended September plunged 60 percent to 154.3 billion won ($132.1 million) from the same quarter last year. The main culprit behind the lackluster performance was sharp fall in returns from invested capital, which dipped to 3.3 percent in the third quarter this year from 4.03 percent recorded two years earlier, due to prolonged low-interest rate environment and rising financial market uncertainties.

Samsung Life Insurance, also of the top 3, had its returns from invested capital slip from 3.9 percent in the fourth quarter last year to 3.5 percent in the third quarter this year. Coupled with a hike in loss ratio, which is a total loss incurred in claims divided by total premiums earned that shows profitability of an insurance company, the company’s net profit for the January-September period this year shrank 43.4 percent compared to a year earlier. The profit had fell sharply against last year, when it reported big one-off gain from selling its stake in affiliate Samsung Electronics, but hike in loss ratio played a greater part in hurting its bottom line.

|

<이미지를 클릭하시면 크게 보실 수 있습니다> |

Insurance claims in the country have been on a steady rise as more patient sought medical treatment under the liberal government’s campaign to improve healthcare for the public. Samsung’s loss ratio has continued to rise since the second quarter last year then even reached 88.4 percent in the third quarter. Hanwha reported 81.5 percent for the loss ratio, up 5.7 percentage points from a year earlier.

Insurance companies generate profit largely from the difference in payouts on claims and premiums received as shown in terms of change in loss ratio, interest income from investing capital such as premiums, and profits from overall business operation.

The challenging environment has defeated the smaller players and will likely trigger an M&A wave.

In September, state-run Korea Development Bank (KDB) launched its fourth attempt to divest KDB Life Insurance, a unit it took over from Kumho Group in return for a bailout in 2010. Tongyang Life Insurance and ABL Life Insurance, in which China’s Angbang Insurance owns a major stake, are expected to return to the sale block. The Korean Teachers’ Credit Union has also sent out invites to sell its majority stake in K Non-Life Insurance Co.

[ⓒ Maeil Business Newspaper & mk.co.kr, All rights reserved]

이 기사의 카테고리는 언론사의 분류를 따릅니다.

기사가 속한 카테고리는 언론사가 분류합니다.

언론사는 한 기사를 두 개 이상의 카테고리로 분류할 수 있습니다.

언론사는 한 기사를 두 개 이상의 카테고리로 분류할 수 있습니다.